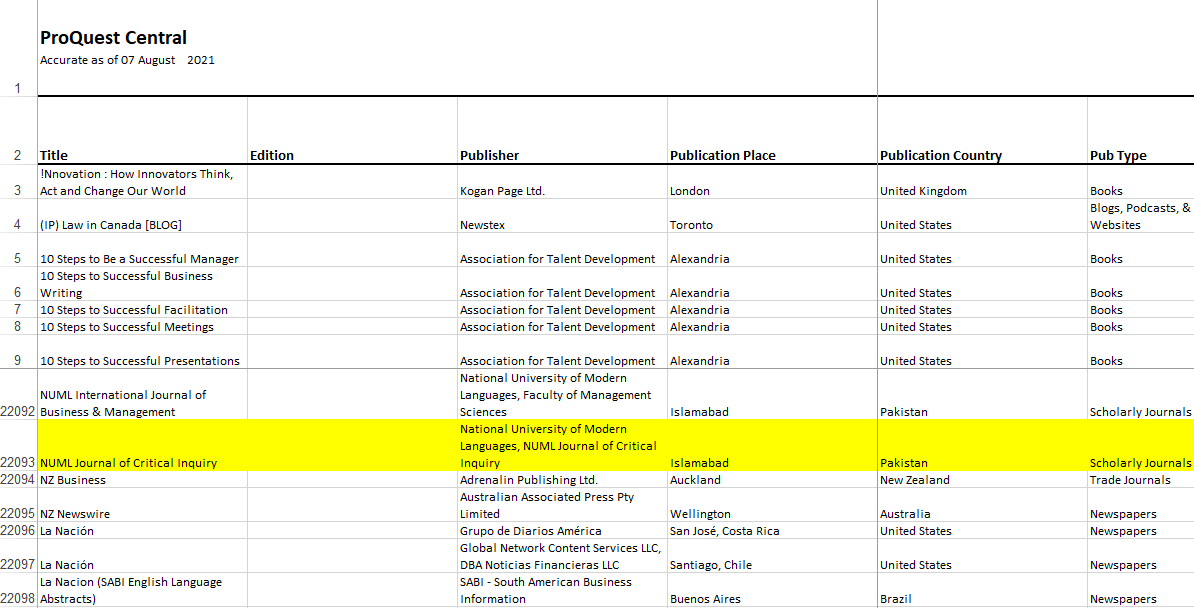

Nexus of Gold Price-Exchange rate-interest rate-Oil Price: Lessons for Monetary Policy in Pakistan

DOI:

https://doi.org/10.52015/nijbm.v16i1.50Keywords:

Gold Price, Exchange rate, Monetary Policy, Decomposition Analysis, VAR Model, PakistanAbstract

This study aims to evaluate the links among gold price, oil price, exchange rate and interest rate in Pakistan. All these channels are interconnected and have impact on monetary policy of the country. Monthly data ranging from 1995-01 to 2016-12 is used for the analysis based on VAR Model. Exchange rate depreciations are responded by tight monetary policy actions, which seem to have a significant effect on exchange rate stabilization process and raise gold price. Changes in oil prices at global level strongly affect the nexus in Pakistan. Monetary policy managers are suggested to take changes in gold prices as indicators of short-run fluctuations in Pakistan economy. The study contributes in two ways. Firstly, as a case study of Pakistan, it analyzes the role of gold market in response to changes in exchange rate and world oil prices. Secondly, the study links up monetary policy decisions to the nexus of gold price-oil price-exchange rate. Findings of the study may be useful for monetary policy makers, academia, and gold industry alike.