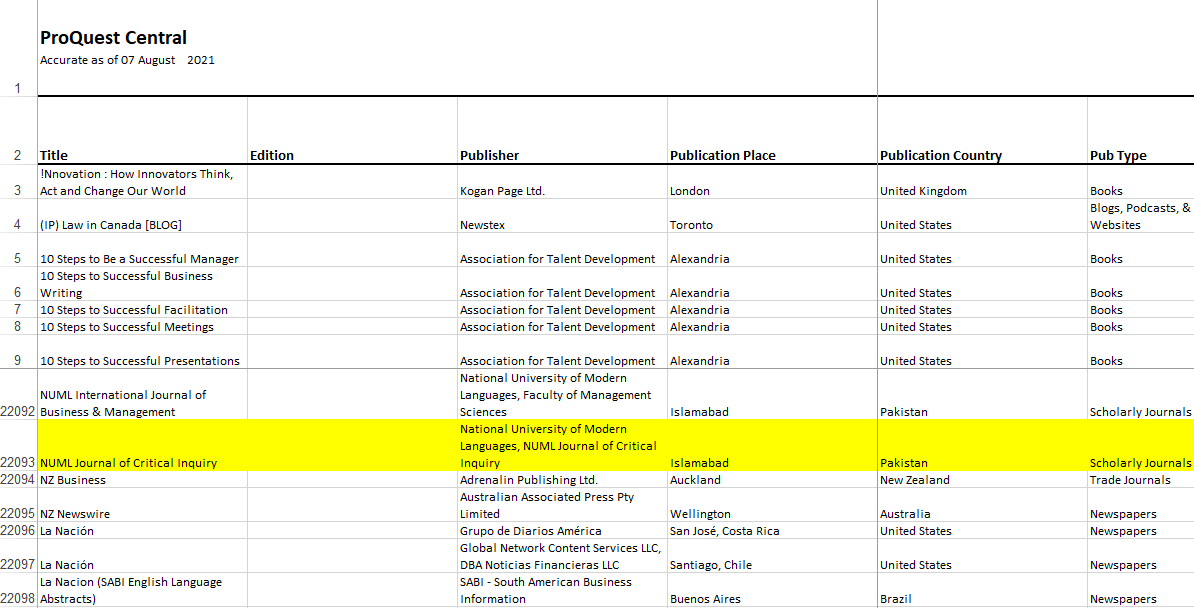

Fiscal Decentralization and Gender Parity in Developing Asia

DOI:

https://doi.org/10.52015/nijbm.v16i1.54Keywords:

Fiscal Decentralization, Gender Parity Index, Control of Corruption, Developing Asian CountriesAbstract

The traditional fiscal decentralization theorem claims that decentralized government can provide the goods and services at local level more efficiently. However, empirically it is still to explore that how fiscal decentralization affects gender parity. This study empirically investigates the impact of fiscal decentralization on gender parity in developing economies of Asia, Armenia, Azerbaijan, Indonesia, Iran, Kazakhstan, Kyrgyz, Mongolia, Myanmar, Thailand and Turkey. The study used dynamic penal da ta technique namely system GMM over the period of 2006-2020. The multidimensionality of fiscal decentralization is captured through three measures of fiscal decentralization i.e. expenditure decentralization, revenue decentralization and composite decentralization. Further, it also examines the complementarity between fiscal decentralization and control of corruption to increase the gender parity. The results of the analysis show that expenditure decentralization is increasing the gender parity in developing economies of Asia. Additionally, control of corruption is a necessary reform to get the desired fruits of fiscal decentralization. Countries must focus on corruption aspect of local governments in implementing the expenditure, revenue and composite decentralization.